About the Author

Slava Kostin, CEO of WislaCode Solutions, is a fintech expert with over a decade of experience in IT and banking. He holds an Executive MBA from IMD (Switzerland).

The banking sector is undergoing a rapid digital transformation, with mobile banking applications leading this evolution. In 2025, we anticipate groundbreaking advancements in banking software that will redefine user experience, security, and financial accessibility. WislaCode experts explore the top five banking app trends and innovations that will shape the future of mobile banking and highlight the best fintech innovations of 2025.

AI-Powered Personalisation and Smart Assistants

Artificial intelligence is playing a pivotal role in enhancing banking applications. AI-driven virtual assistants and smart analytics provide users with personalised financial advice, automated budget management, and fraud detection.

How AI Enhances Mobile Banking

Example: Envision a banking app that learns your financial behaviour and proactively suggests investment opportunities or alerts you about unnecessary subscriptions.

Biometric Authentication and Advanced Security Measures

With the rise in cyber threats, financial institutions are integrating biometric security features into banking applications. Traditional passwords are being replaced by facial recognition, voice authentication, and fingerprint scanning.

Banking is no longer confined to standalone apps. Embedded finance enables seamless financial services within third-party applications, allowing users to access loans, payments, and investments directly from e-commerce platforms, ride-hailing apps, and social media.

Why is Embedded Finance a Game-Changer?

Example: A retail app offering instant financing for purchases at checkout – without requiring a separate banking app.

Decentralised Finance (DeFi) and Blockchain-Based Transactions

Decentralised finance (DeFi) is disrupting traditional banking by enabling peer-to-peer transactions, lending, and investments without intermediaries. With blockchain technology, banking apps in 2025 will offer faster, more secure, and transparent financial transactions.

| Feature | Benefits |

|---|---|

| Smart Contracts | Automate transactions without middlemen |

| Instant Settlements | Reduce transfer time from days to seconds |

| Enhanced Security | Tamper-proof transactions and fraud prevention |

Best fintech innovations in 2025 will likely include blockchain-powered digital wallets, cross-border payments, and tokenised assets directly within mobile banking apps.

Open Banking and API-Driven Ecosystems

Regulatory changes and customer demand for seamless banking experiences are driving the growth of open banking. With secure APIs, third-party developers can create innovative financial tools that integrate directly with banks.

Benefits of Open Banking

Example: A budgeting app connected to multiple banks, offering real-time financial insights and AI-driven investment suggestions.

The future of mobile banking is driven by user demand for security, personalisation, and seamless financial experiences. In 2025, banking apps will evolve into intelligent financial assistants, offering:

The best fintech innovations in 2025 will redefine mobile banking by integrating cutting-edge technology into everyday financial activities. Expect:

Banking is no longer solely about transactions – it’s about delivering seamless, secure, and intelligent financial experiences. Financial institutions that embrace these banking app trends in 2025 will gain a competitive edge in the ever-evolving fintech landscape.

WislaCode creating unified platforms that combine multiple services into one seamless and secure experience.

In writing this article, we drew on WislaCode Solutions’ extensive experience in banking software development, providing insights into the future of mobile banking and the best fintech innovations of 2025. Want to build a next-generation banking app? Our team specialises in developing secure, AI-driven, and scalable fintech solutions tailored to modern banking needs.

Let’s create the future of digital banking together!

In 2025, banking apps will include top features like AI for personalised advice, biometric security for strong authentication, and blockchain for secure, instant transactions. Look for voice-powered transactions, tools for sustainable finance, and super apps that blend banking with lifestyle services.

AI-driven banking will transform mobile banking with real-time chatbots for transactions, predictive analytics for fraud detection, and personalised insights for budgeting and investing. This will create a seamless, proactive user experience, helping customers manage their finances more effectively.

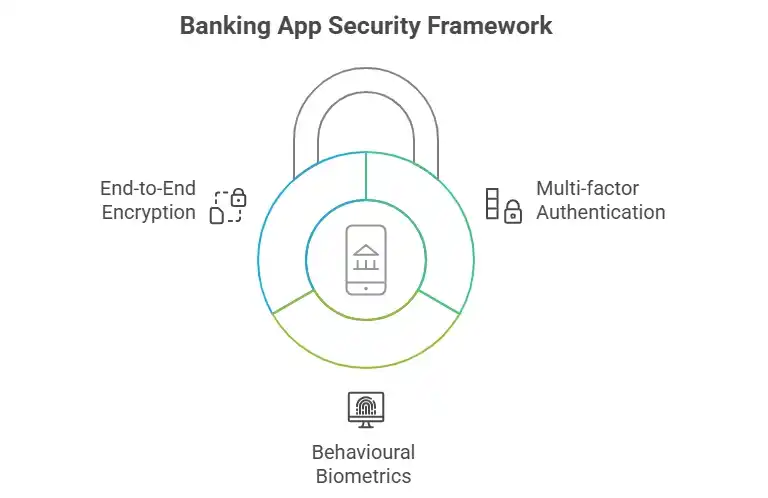

Biometric security, including facial recognition, voice authentication, and behavioural biometrics, enhances user safety by replacing traditional passwords. When paired with multi-factor authentication and end-to-end encryption, these tools protect sensitive data, meeting the growing need for secure mobile banking.

Open banking API integration enables third-party developers to create innovative tools, providing users with greater financial transparency and control. It accelerates loan approvals and delivers real-time financial insights and personalised services by connecting banking apps to various financial platforms.

Embedded finance integrates banking services, such as loans, payments, and investments, into third-party platforms like e-commerce or ride-hailing apps. By embedding these services, users gain swift access to financial tools without switching applications, fostering the growth of super apps and delivering a seamless user experience.

Blockchain in mobile banking will enable swift, secure transactions. It leverages smart contracts for efficiency and ensures instant settlements. Features like digital wallets and cross-border payments will become more secure and efficient, reducing reliance on intermediaries and fostering trust in 2025 banking apps.

Slava Kostin, CEO of WislaCode Solutions, is a fintech expert with over a decade of experience in IT and banking. He holds an Executive MBA from IMD (Switzerland).