Let's get in touch and discuss your case

Let's start negotiating and develop your own unique project. Our team is ready for the most daring projects.

Moving from standard banking with a set of basic functions to a digital bank where everything can be done online.

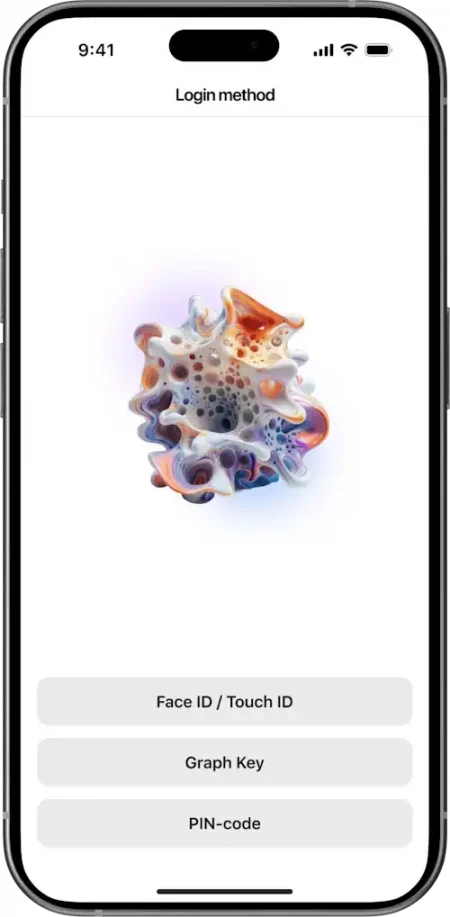

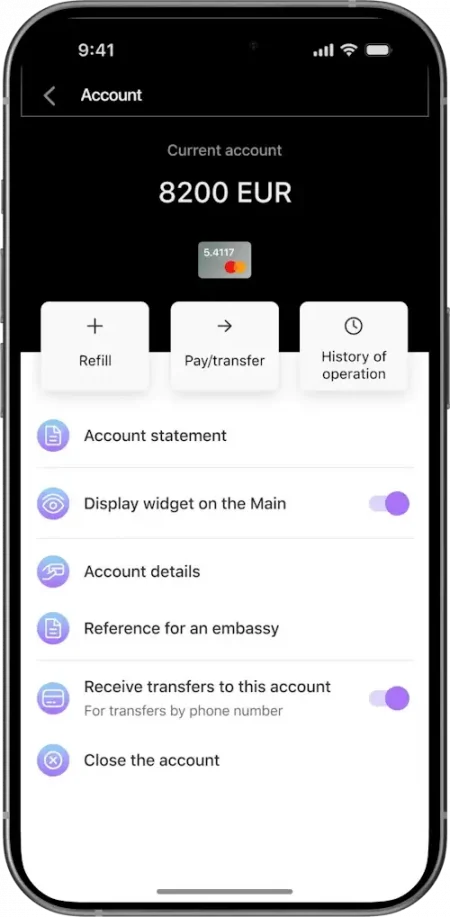

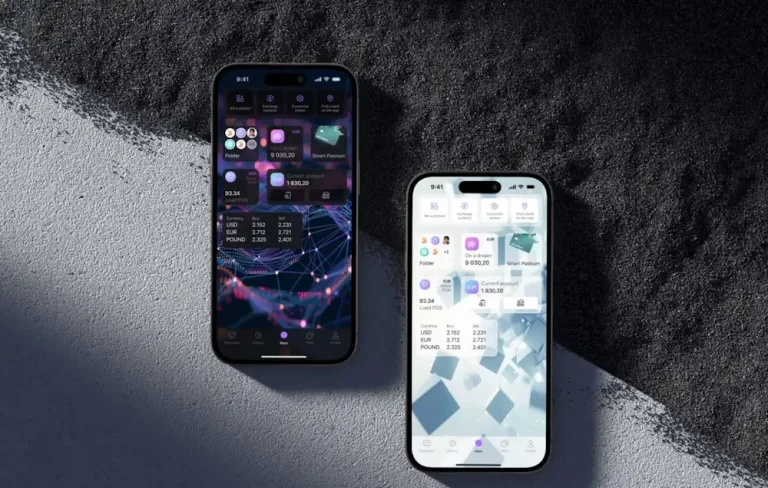

The Bank wanted to switch to a new way of interacting with customers via a mobile application. Instead of standard banking services with a set of basic functions, we moved to a digital bank where everything can be done online: from client registration to any payments.

Result: 700+ thousand customers use the app.

Let's start negotiating and develop your own unique project. Our team is ready for the most daring projects.

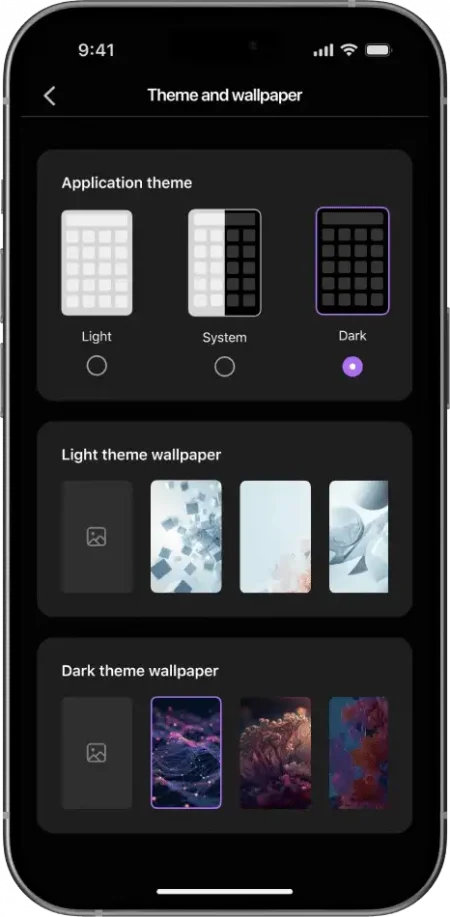

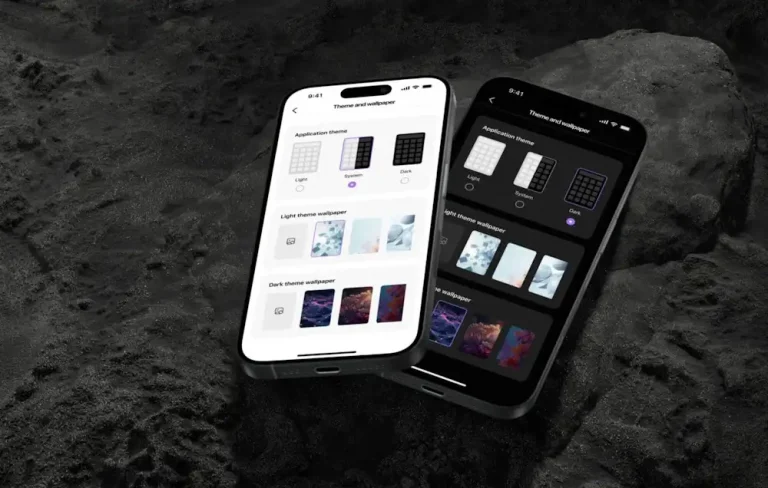

Dark or light theme, desktop background, widget settings, widget placement and even size – it’s all up to the user.

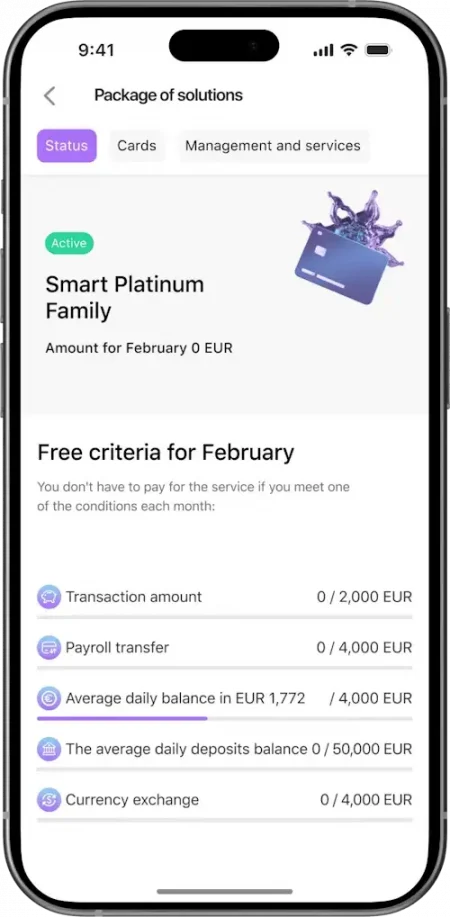

In addition, the application itself adapts to the user and offers relevant services based on the user’s transactions and account balances. For example, to take a loan or open a deposit in a bank.

We are equipped with an Agile mindset – flexible, transparent, and results-driven at every stage.

20+ years of experience in managerial positions in IT and banking.

20+ years of experience as a developer, analyst, and solutions architect.

We use cookies and similar technologies to make our site work, improve your experience, and deliver personalized content.

Please see our Cookie Policy for further details and make your choice below.