Viacheslav Kostin

CEO WislaCode Solution

Request our pitch deck

See what we build, how we deliver, and why fintech teams work with us.

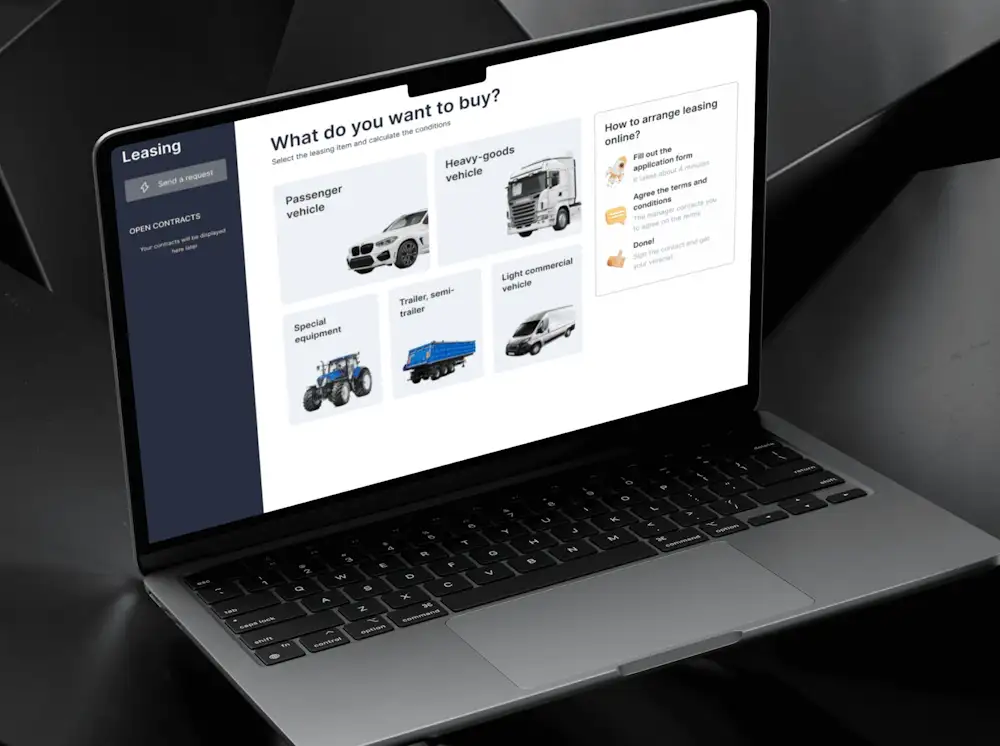

Streamline leasing operations from payments to reporting with an all‑in‑one leasing management platform designed to save time and improve productivity. Your team can manage the entire lease lifecycle seamlessly, from generating lease quotes to contract execution and reporting, with robust financial tools to support accurate accounting.

Who benefits from our solutions?

Unified leasing workspace: Replace scattered spreadsheets and disconnected tools with a single platform for quoting, underwriting, contracting, servicing and reporting. Role‑based access, audit trails and configurable workflows reduce hand‑offs and errors while keeping sensitive data under control.

Effortless ERP and CRM connectivity: Standardised APIs and event streaming connect seamlessly to your ERP, CRM, accounting and payment providers. Idempotent operations and versioned contracts preserve data integrity, while near real‑time sync keeps finance and operations aligned.

Viacheslav Kostin

CEO WislaCode Solution

See what we build, how we deliver, and why fintech teams work with us.

A vehicle lessor needed to escape phone‑and‑email bottlenecks and accelerate approvals. We built a secure customer account, a dealer portal and deep integrations with internal systems – covering search and booking, applications, contracts, invoicing and document management. Routine enquiries were automated, tasks were routed to the right teams, and funnel analytics became visible.

Outcome: a 68% reduction in contact‑centre workload, faster cycle times and a scalable foundation for new products.

We understand the realities of origination, mid‑term changes and end‑of‑term options across vehicle and equipment portfolios. That knowledge shapes pragmatic workflows, data models and controls that teams adopt quickly.

20+ years of experience in managerial positions in IT and banking.

20+ years of experience as a developer, analyst, and solutions architect.

We use cookies and similar technologies to make our site work, improve your experience, and deliver personalized content.

Please see our Cookie Policy for further details and make your choice below.